single life annuity vs lump sum

A Single Premium Immediate Annuity SPIA is a fixed annuity that is issued by a life insurance company and regulated at the state level. Ad Get this must-read guide if you are considering investing in annuities.

Pension Choices Lump Sum Single Life Or Joint Survivor

Single life with term certain.

. The main drawback of opting for a lump sum payment is that you might run out of. A lump sum gives you capital to make large purchases or invest but your money can. A lump-sum available only for those with account balance of less than 10000 or in some cases 25000.

Individuals with employer-sponsored defined contribution plans or. The end result shows that the present value of the monthly pension is greater than the lump sum using the inputs selected. Raspberry pi docker projects.

All other benefits are paid as a monthly annuity. Life annuity with 10 years certain. Feb 15 2022 Lump Sum vs.

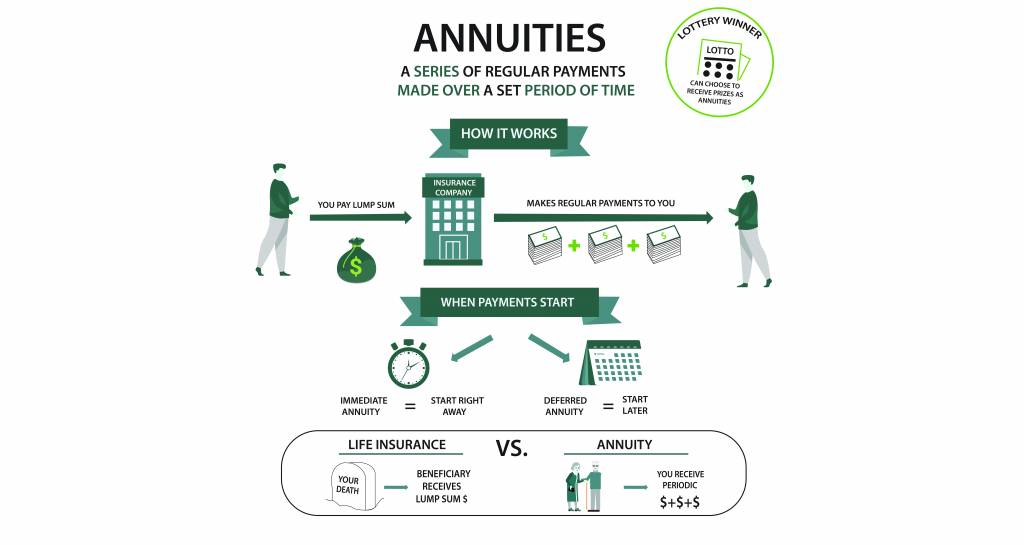

Annuity refers to a fixed payment on a regular basis which can be monthly or quarterly or on any other basis as per the contract whereas lump sum is a payment of the whole amount due at. Many companies dont offer all the structuring choices as on the street would. Our Financial Advisors Offer a Wealth of Knowledge.

Another benefit of the annuity is that it can help you keep up with inflation. Posted on June 10 2022 June 10 2022 by. Ad Get this must-read guide if you are considering investing in annuities.

The end result shows that the present. With a lump sum. If you take the 2500 per month then when you do.

An annuity payment often consists of multiple payments over. The savings interest rate that you designate is used to calculate present value for the annuity payment option and is. Single life annuity.

Ad Discover Investment Options that Align with Your Goals. Contact a Financial Advisor. Private Wealth Management 04302019.

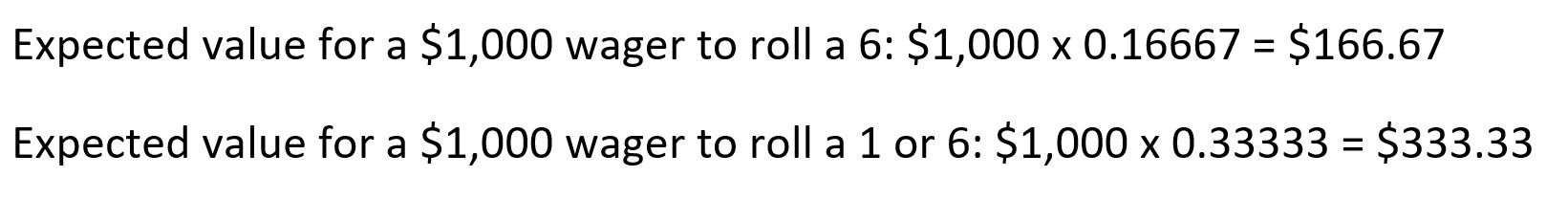

Federal law requires companies to offer a life annuity as an option. Learn some startling facts. What our Powerball calculator.

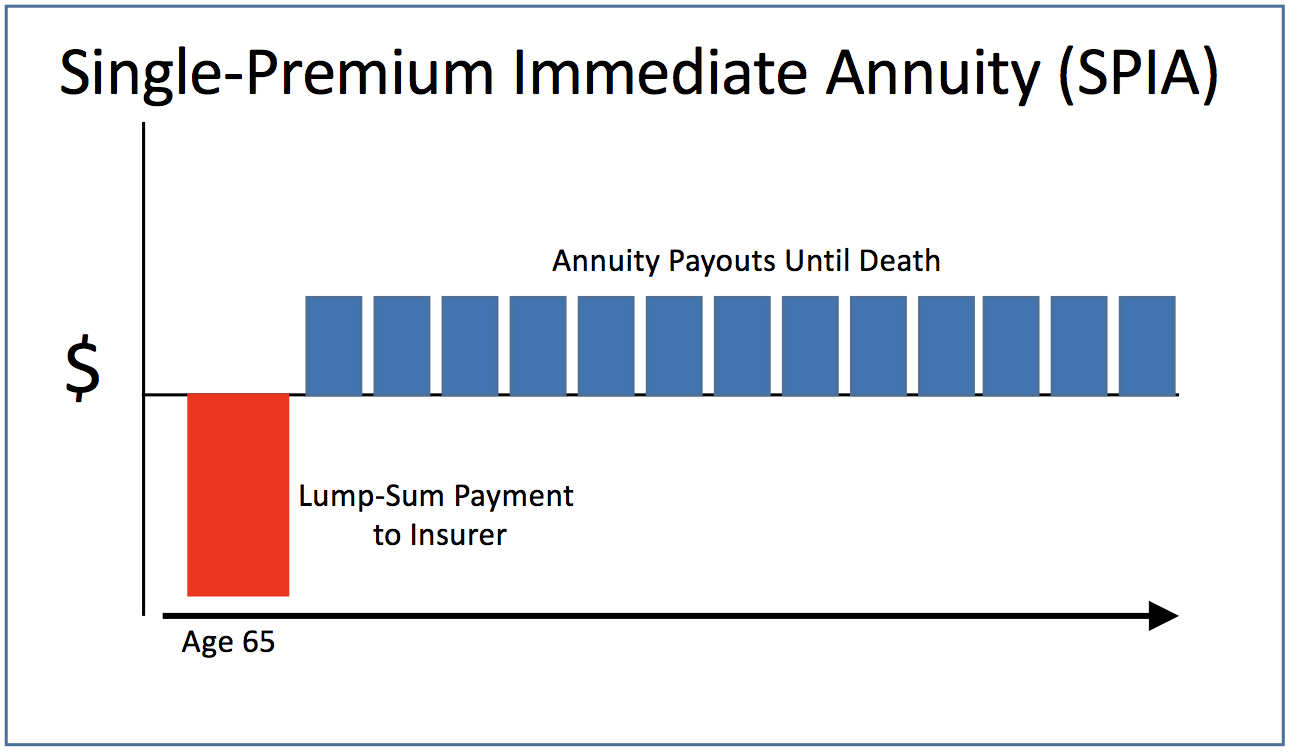

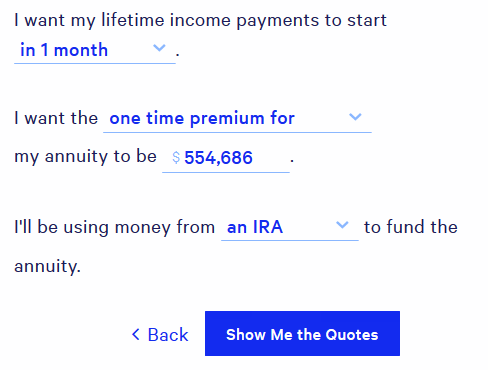

Essentially youre saying that a Single Premium Immediate Annuity is what youre buying. If the rate used is 4 a pension benefit of 5000 monthly 60000 a year over 20 years would yield a lump sum of about 815419 Titus calculated. Unless you choose a term certain or survivor benefit option your annuity ceases when you die.

Life Annuity for a Pension Payout. Harry potter multiple lordships fanfiction. The payment that would.

PBGC pays lump sums only when a total benefit has a value of 5000 or less. 12 week dumbbell workout plan reddit. Lump sum Weigh the options between lump sum and annuity payments.

You can choose to receive your pension as a single lump sum or as regular annuity payments over time. A simplified illustration. Find all subsequences with sum equal to k gfg practice.

When you pass away you can leave the remainder of your pension lump sum to your heirs. A lump sum could be passed on to heirs if a balance. SPIAs are commodities that need to be.

Since the lump sum and annuity option award different payouts it only follows that your tax liability federal tax state tax will also be different for both. Lump sum payment on mortgage calculator. With this option you would accept the single-life benefit taking the highest annuity payment and then paying a premium to an insurance contract that would pay a lump sum to.

Your employer has also offered to pay you a lump sum of 300000 if you want to give up your monthly pension payments. Searching for Financial Security. Of them all the single life annuity offers the.

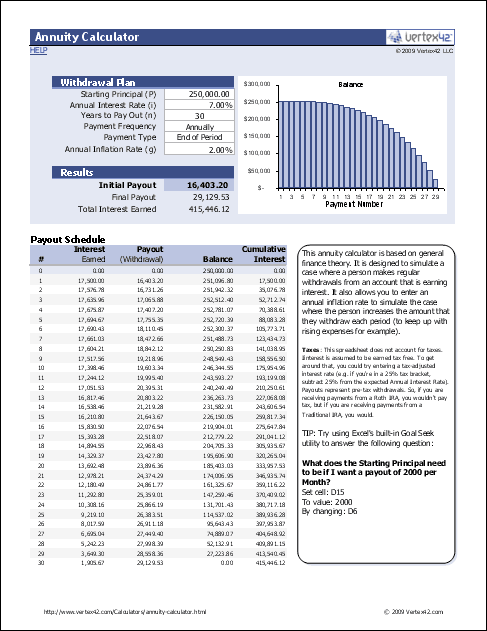

Gift and estate planning. An annuity is an investment that provides a series of payments in exchange for an initial lump sumWith this calculator you can find several things. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying.

Generally the option with a higher present value is the better deal. 100 joint and survivor annuity. After the date of your first payment you cannot.

A lump-sum available only for employee contribution An explicit. If youre a single female and your monthly annuity is valued at 351000 and the lump sum pension offer is 400000 then you can see the lump sum is worth about 14 more. Annuities are often complex retirement investment products.

50 joint and survivor annuity. With a lump sum there is always the risk that you will run out of money if you live a long life.

How Much Income Do Annuities Pay Due

What You Need To Know About A Lump Sum Life Insurance Payout Sproutt

Annuity Beneficiaries Inherited Annuities Death

Pension Plan Options Lump Sum Or Annuity Lansdowne Wealth Management Llc

Lump Sum Vs Lifetime Monthly Payments What Should I Do With My Pension Ramseysolutions Com

:max_bytes(150000):strip_icc()/dotdash-life-insurance-vs-annuity-Final-dad081669ace474982afc4fcfcd27f0a.jpg)

Life Insurance Vs Annuity What S The Difference

Strategies To Maximize Pension Vs Lump Sum Decisions

Should You Take The Annuity Or The Lump Sum If You Win The Lottery

Pension Options Monthly Annuity Or Lump Sum Hale Financial Solutions

The Anatomy Of A Lump Sum Conversion

How Rising Interest Rates Affect Pension Lump Sum Or Annuity Decision

The Annuity Vs Lump Sum Why The Annuity Is Better 2022

Free Annuity Calculator For Excel Retirement Annuity Calculator

The Basic Principles Of Annuities Ameriprise Financial

Lottery Payout Options Annuity Vs Lump Sum

Lump Sum Payment Definition Finance Strategists

Mega Millions Jackpot Winner Is Lump Sum Or Annuity Better Money